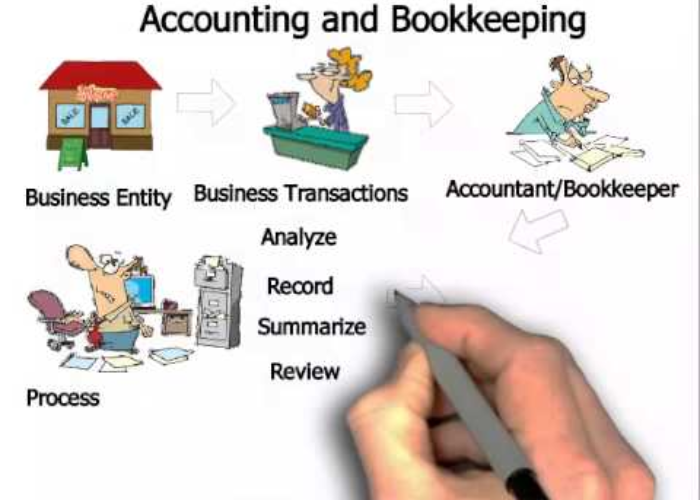

Accounting and Bookkeeping are two of the most important aspects of running a successful business. They provide the foundation for financial decisions and help businesses stay organized. Understanding how to use accounting and bookkeeping can help business owners make informed decisions and keep their finances in order.

Definition of Accounting and Bookkeeping

Accounting is the process of recording, organizing, and interpreting financial information. This includes tracking income and expenses, creating financial statements, and analyzing financial data. Bookkeeping is the process of recording the day-to-day financial transactions of a business. This includes entering debits and credits into the accounting software, reconciling accounts, and preparing financial reports.

The Basics of Accounting

The basic principles of accounting are the foundation for all accounting processes. The four main principles are the cost principle, the revenue principle, the matching principle, and the accrual principle. The cost principle states that all assets should be recorded at their historical cost. The revenue principle states that revenue should be recorded when it is earned, not when it is received. The matching principle states that expenses should be matched with revenue earned in the same period. The accrual principle states that revenue and expenses should be recorded in the period in which they occurred, not when the money is received or paid.

How to Account for Business Transactions

Business transactions are recorded in the accounting software using debits and credits. Debits increase the balance of an asset or an expense account and decrease the balance of a liability or an income account. Credits decrease the balance of an asset or an expense account and increase the balance of a liability or an income account. It is important to note that the total amount of debits must always equal the total amount of credits.

Recording Transactions in Financial Statements

All business transactions are recorded in financial statements. Financial statements show the financial position of a business at a given point in time. The three most common financial statements are the balance sheet, income statement, and statement of cash flows. The balance sheet shows the assets, liabilities, and equity of a business. The income statement shows the revenue and expenses of a business over a given period of time. The statement of cash flows shows the movement of cash in and out of a business.

Types of Accounts

There are five main types of accounts in accounting: asset, liability, equity, revenue, and expense. Asset accounts include cash, accounts receivable, inventory, and prepaid expenses. Liability accounts include accounts payable, notes payable, and accrued expenses. Equity accounts include common stock and retained earnings. Revenue accounts include sales and service revenue. Expense accounts include the cost of goods sold, salaries, and rent.

Analyzing Financial Statements

Financial statements can be used to analyze the financial performance of a business. Ratios such as the current ratio, quick ratio, and debt-to-equity ratio can be used to measure the liquidity, solvency, and financial leverage of a business. Profitability ratios such as the gross profit margin and net profit margin can be used to measure the efficiency of the business.

The Accounting Cycle

The accounting cycle is the process of recording, classifying, and summarizing financial information. The accounting cycle consists of the following steps: journalizing transactions, posting to ledger accounts, preparing an unadjusted trial balance, adjusting entries, preparing an adjusted trial balance, preparing financial statements, and closing entries.

Using Computerized Accounting Systems

Computerized accounting systems are used to automate the accounting process. These systems can be used to record transactions, generate financial statements, and analyze financial data. Most computerized accounting systems use double-entry bookkeeping, which ensures that the total amount of debits equals the total amount of credits.

Understanding Different Types of Taxes

Businesses are subject to various types of taxes such as income tax, sales tax, and payroll tax. Income tax is based on the profits of the business. Sales tax is based on the sales of goods and services. Payroll tax is based on the wages paid to employees. It is important to understand the different types of taxes and how they affect the finances of a business.

Conclusion

Accounting and bookkeeping are essential tools for running a successful business. Understanding the basics of accounting and bookkeeping is essential for business owners to make informed decisions and keep their finances in order. Having a solid understanding of the different principles, processes, and types of accounts will help business owners manage their financial records and make informed decisions.